As electric mobility is set to overhaul the transportation sector, it offers a rare chance to make the system sustainable from the ground up — to maximise the recovery of battery material while ensuring that heavy metals and other problematic toxins from this e-waste do not end up in a landfill and contaminate the environment.

A big step in this direction has been the notification of the Battery Waste (Management and Handling) Rules, 2022, which address concerns around lithium-ion batteries from electric vehicles. The Rules bring within its ambit all manufacturers, producers, collection centres, importers, re-conditioners, refurbishers, dismantlers, assemblers, dealers, recyclers, auctioneers, vehicle service centres, consumers and bulk consumers.

The Rules said producers, which include battery manufacturers, importers and automakers that produce products with batteries, “shall have the obligation of Extended Producer Responsibility (EPR) for the Battery that they introduce in the market to ensure the attainment of the recycling or refurbishing obligations”.

This means they will have to collect, either directly or through third-party vendors, waste batteries from the market and ensure the collected batteries reach authorised recyclers and not end up being landfilled or incinerated. Producers will also be required to file an annual record of sales and buyback with the state pollution control board (SPCB) and ensure safe collection and transportation of batteries to authorised / registered recyclers.

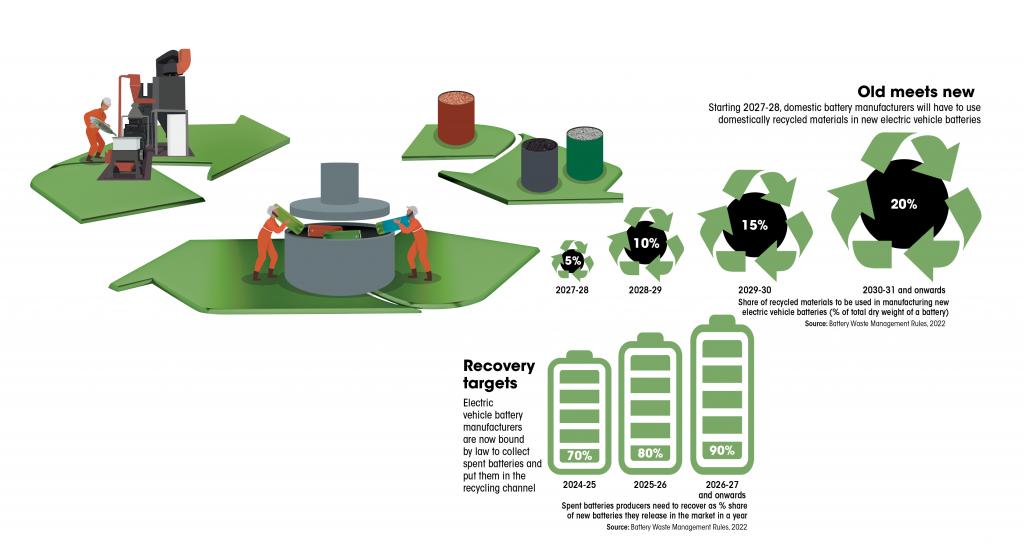

The Rules have for the first time defined measurable targets for collection and recycling within a compliance timeframe. They have set a target of 90 per cent recovery of the battery material — 70 per cent by 2024-25, then 80 per cent by 2026, and 90 per cent after 2026-27 onwards (see ‘Recovery targets’).

Producers will also have to include 5 per cent of recycled material in the total dry weight of a cell by 2027-28, expanding to 20 per cent by 2030-31. In case of imported cells, the producer has to meet the obligation by getting the same amount of recycled materials utilised by other businesses or by exporting a similar amount of materials (see ‘Old meets new’).

To ensure compliance with the obligations as well as safe and formalised recycling of batteries that are in use, the 2022 Rules mandated that EPR registration system will be managed online on a portal by the Central Pollution Control Boards (CPCB). The portal, which is yet to be operational, will enable producers to engage a third-party or recycler to collect and process the waste and will empower recyclers to issue EPR certificates to producers based on the quantity of battery they send for recycling.

“When producers file their returns, they will have to declare how many batteries they released on the market and how many were collected and recycled to obtain EPR certificates. CPCB will charge a fee for the upkeep of the portal management and registration of producers. We are currently developing standard operating procedures about the entire process and guidelines on labels. SPCBs are expected to audit the recycling centres and also monitor compliance,” a CPCB official told Down to Earth (DTE).

The portal will even allow producers who have surplus EPR certificates to trade them with other producers who have not fulfilled their EPR commitments. The Rules require CPCB to lay down guidelines for imposition and collection of “environmental compensation” on producers and recyclers who are non-compliant. Currently, 59 automakers and 11 battery recyclers have registered for recycling battery waste.

Need further rejig

Though a step in the right direction, the 2022 Rules suffer from a few critical gaps that unless addressed can impede efficient and effective recycling. The labels on batteries in India currently require to carry an icon (a crossed bin) which indicates that the batteries cannot be disposed of in regular bins.

The labels should also provide information on the metals in the lithium-ion battery to help recyclers identify what can be recovered. Some of the recyclers that DTE spoke to said that they employ chemists to ascertain the chemical composition of the battery, which is time- and resource-consuming.

There is also a need to tweak the current policy so that it allows recycling-friendly design of cells and batteries. Battery packs, for instance, are screwed, welded and have module pieces stuck together with adhesive. This makes separation of parts difficult. If screw connections and other joining techniques are standardised, it will enable automated disassembly of cells.

Materials could also be designed for easier end-of-life management. For example, a water-based binder for electrode materials can reduce the use of toxic solvents to separate the current collector from the active material during recycling. There are other concerns among the industry. The EPR strategy does not talk of the budget battery manufacturers should earmark for collecting and recycling spent batteries. In the absence of this, the price that producers might end up paying to recyclers under EPR might be too low, as has been seen in the case of other e-waste streams.

“EPR is linked to the actual production and the numbers need to be verified and audited. What is happening in other e-waste streams is that EPR rates have come down to single digits per kilogramme. This means they are not processing the e-waste. They are just showing documentation and moving the same shipments round and round. Such low EPR rates are not feasible,” said Dolwani.

He said in the absence of a mandatory budget, manufacturers at most agree to pay the spot price, which is set by informal recyclers and this leads to leakages in the waste collection chain as they typically lack infrastructure to manage battery waste.

This might not be a problem with electric vehicle batteries initially as the market is largely formalised right now with vehicle owners typically replacing their spent batteries at vehicle dealer networks. As the volume of spent batteries increases, the informal sector may directly approach dealers handling multi-brand products by outpricing formal collectors. This may lead to hazardous practices in recycling.

Recyclers are also worried about the changing chemical composition of lithium-ion batteries. After a series of incidents of electric two- and three-wheelers catching fire, domestic electric vehicle manufacturers are migrating towards safer, but less energy-dense lithium iron phosphate (LFP) batteries. These batteries are cheaper because they do not contain expensive metals such as cobalt and nickel.

From a recycling perspective, it is only lithium in these cells that brings value. But the proportion of lithium is also minimal. If the recycler is only capturing lithium carbonate (the form in which lithium is included in the cell) from LFP cells, it will become unviable for the recycler, said Verma.

It might be financially challenging for recyclers to handle LFP in India until the government comes up with a framework that can encourage original equipment manufacturers to pay recyclers, said Srivastava. He added that recyclers in the US and European Union are paid by vehicle manufacturers to recycle LFP as it has negative value.

The industry is also concerned over the lack of rules for storage, transport and handling of electric vehicle batteries that may lead to serious safety concerns, especially if the informal sector becomes more active in this. The 2022 Rules allow informal collectors and transporters to be registered on the central portal. But they need to be organised as an entity as well as audited for environmental safeguards.

The other challenge lies in the fact that several state governments have released their electric vehicle policies that also talk of battery recycling. There is little clarity right now on how these state-level policies will work in tandem with the 2022 Rules. Delhi’s electric vehicle policy, for instance, promotes the reuse of batteries through private sector participation and encourages establishment of recycling businesses.

Punjab is promoting automakers to issue buyback schemes for used battery packs. The state is also creating an e-marketplace to encourage resale of used batteries along with incentives to promote resale.

Telangana’s electric vehicle policy focuses on reuse of lithium-ion batteries in stationary energy storage applications and promotes collaborations between battery and vehicle manufacturers, recyclers and energy storage operators. It also provides incentives to recycling businesses for ultra-processing.

Tap global learning curve

The country can learn from the experiences and interventions brought in other countries globally. The US Inflation Reduction Act, 2022, allows recycled battery materials (lithium, cobalt, and nickel) to qualify for significant tax credits available through the domestic materials clause, even if those materials were not originally mined in the US or in countries with which the country has free-trade agreements.

Additionally, California is bringing about policy reforms for end-of-life reuse and recycling of batteries and very stringent labelling regulations. The EU has also instituted its End-of-Life Vehicles Directive that mandates automakers to take back vehicle owners’ end-of-life batteries.

The EU’s “Fit for 55” package has further promoted automakers’ interest in recycling by requiring the publication of battery carbon footprints, as well as by setting collection and recycling targets including minimum recycled content requirements for newly built batteries.

In December 2022, the EU introduced new regulatory reforms aimed at building a circular economy for electric vehicle batteries. The European Commission has introduced new reforms through a digital tool called “battery passport”. The tool seeks a carbon footprint declaration for batteries sold in Europe starting 2024.

Meanwhile, China has heavily incentivised battery recycling with the intention of using recycled raw material available within the country. The regulations encourage standardisation of battery design, production and verification to improve assembly and dismantling of used batteries. This also makes a provision for repairing and repackaging for second life utilisation. Considerable recycling scale has been attained.

Foshan-based Guangdong Brunp in China has a capacity of recycling 120,000 tonnes of batteries per year. This is the equivalent of what would be used in over 200,000 cars.

Thus, global research efforts are looking at improving the process to make recycled lithium economically attractive. As the target for zero-emission transition gets more ambitious, and domestic electric vehicle manufacturing and market grow, more spent batteries will flood the recycling market. Recovering the valuable material locked inside the batteries has to be the priority to improve material security, minimise waste and control environmental hazards. Battery waste material is the new oil.

(With inputs from Rohit Garg, Mrinal Tripathi and Rohan Malhotra)

The story first appeared in the print edition of Down To Earth for October 16-31, 2023.

We are a voice to you; you have been a support to us. Together we build journalism that is independent, credible and fearless. You can further help us by making a donation. This will mean a lot for our ability to bring you news, perspectives and analysis from the ground so that we can make change together.