New scheme reduces financial support significantly but does well in some key aspects

On April 1, 2024, the Electric Mobility Promotion Scheme (EMPS), 2024 came into effect in India. The initiative will support adoption of electric two-wheelers and three-wheelers through demand incentives, while pushing for development of an electric vehicle (EV) manufacturing ecosystem in the country.

EMPS comes on the heels of the conclusion of the second iteration of Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles scheme or FAME II, that played a pivotal role in influencing the shift in focus of consumers and industry towards electric mobility.

FAME II outlaid ₹11,500 crore, lasting for five years from 2019 to 2024, with a target to support 1.74 million vehicles, including two- and three-wheelers, commercial four-wheelers including cabs and light commercial vehicles, and buses. The total incentive allocation under EMPS has been reduced to ₹500 crore for a period of four months, April 1-July 31, 2024, to support 370,000 electric two-wheelers, e-rickshaws, and electric auto rickshaws exclusively.

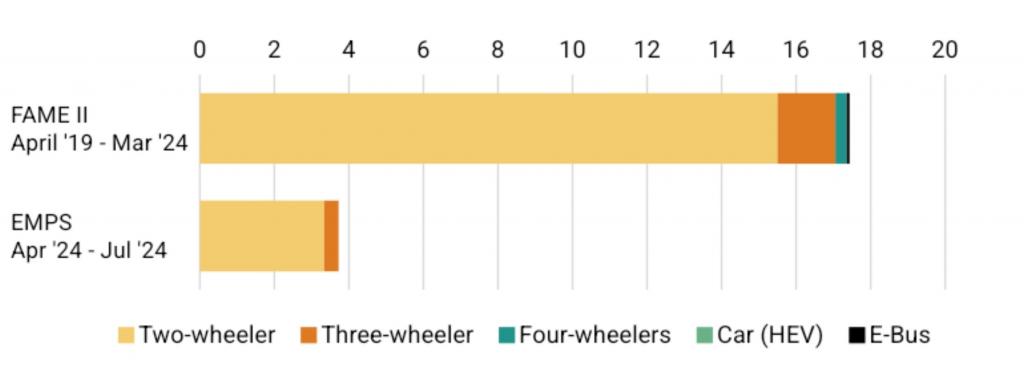

Sales target (in 100,000), FAME vs EMPS

Source: Department of Heavy Industries; Note: FAME II initially earmarked a support fund of ₹10,000 crore, which was later enhanced to ₹11,500 crore in December 2023, and support was extended to 1.74 million vehicles from 1.56 million vehicles

Multiple caps, fewer benefits

EMPS offers an incentive of ₹5,000 per kilo-watt hour of battery capacity. The amount cannot exceed 15 per cent of the ex-factory cost (price of vehicle at factory gate before applicable taxes), or ₹10,000 (two-wheelers) / ₹25,000 (e-rickshaws and e-carts) / ₹50,000 (e-autos), whichever is lower for each segment.

FAME II only had one cap on the maximum incentive a vehicle can receive. All vehicle segments except buses received ₹10,000 per kWh of battery capacity upto 20 per cent of ex-factory cost. Buses received ₹20,000 per kWh upto 40 per cent ex-factory cost.

The single capping system enabled FAME to provide higher incentives to more expensive vehicles. EMPS reduces monetary support substantially, increasing the price of vehicles. Delhi-based think tank Centre for Science and Environment (CSE) estimated that EMPS will lead to an average incentive reduction by 63 per cent for two-wheelers, 37 per cent for e-autos and 38 per cent for e-rickshaws.

Reduction in incentives

Source: CSE analysis

Re-registration roadblock

The central incentive to EVs is given directly to the manufacturers on sales of registered vehicles, so that the consumer enjoys an automatic discount during purchase. EMPS asks for re-registration of original equipment manufacturers (OEM), their dealers and vehicles on an online portal to be eligible for subsidies. Vehicles manufactured before the certification approval will not receive discounts, making it challenging for OEMs to liquidate their already existing vehicle stocks.

The industry fears that in the 120-day programme, the certification process may take between 30 to 45 days, during which the vehicles will be sold without subsidies, and consumer demand will plummet, unless OEMs offer heavy discounts out of their own pockets.

The Union Ministry of Heavy Industries (MHI) has begun rolling out manual certificates for the benefit of manufacturers starting April 2, 2024. Companies such as Ola, TVS and Hero MotoCorp have managed to get such certificates from MHI by the time the online portal is ready, which is not expected before the third week of April.

Two- & three-wheelers at the core

Despite its challenges, what EMPS does well is maintain focus on the segments which have led the electric vehicle revolution in India.

The first iteration of FAME was launched in India in 2015. Since then, electric two-wheeler and three-wheeler segment have attracted the highest demand among consumers compared to cars and other commercial segments due to lower acquisition costs, lower running costs, ease of charging and parking, among other reasons.

FAME supported over 100,000 two-wheelers accounting for 39 per cent of the total sales between 2015 and 2019. However, the majority of the sales were attributed to lead-acid battery vehicles.

FAME II (2019-2024) refined its approach by emphasising on advanced battery technologies. States came with electric vehicle policies across the country during the same period, playing a vital role for high two-wheeler and three-wheeler demand, with additional incentives and manufacturing support. India went from seven states with electric vehicle policies in 2019 to 28 states in 2023.

Cumulative sales under FAME II (left); FAME II target vs registrations

CSE calculations based on data from FAME India dashboard, Department of Heavy Industries

By the end of FY 2021-22, 250,000 two-wheelers and 41,000 three-wheelers were sold under FAME II. In the last two years, two-wheelers and three-wheelers saw an annual average increase of 151 per cent and 96 per cent under FAME.

Cumulatively FAME II concluded in FY 2023-24 supporting 1.38 million two-wheelers and 155,000 three-wheelers, achieving 89.5 per cent and 100 per cent respectively of the sales target under the scheme. The other segments were nowhere near close to meeting the sales targets.

So, if EMPS is part of the plan to phase out incentives for EVs, focusing on these two segments for the last stretch is a wise choice, where the incentives are most efficiently utilised.

Beginning of central demand incentive phaseout

Gradual reduction of financial support is an important step to ensure fiscal sustainability in the industry and for market-driven development of a sector rather than policy-driven.

Numbers suggest that two-wheelers and three-wheelers are the low-hanging fruits for electric mobility, even more so in the commercial segment which is not driven by consumer demand and can be regulated more strictly through policies.

At the same time, the electric vehicle policy ecosystem in India lacks the critical pre-requisites to qualify an incentive phase-out programme as a positive development. In markets where such incentive phase-out programmes have worked, other fiscal and non-fiscal instruments kept the industry stimulated. Learnings from some tested practices:

- The phase out policy should be gradual, with ample warning to consumers and industries. When China decided to discontinue its subsidy scheme, a phaseout plan was put into action for three years (2020-22), reducing incentives by 10 per cent in the first year to 30 per cent in the last, before completely discontinuing by the end of 2022

- A zero-emission mandate is a viable supply-side catalyst. It requires all vehicle manufacturers to produce a stipulated number of electric units in its total fleet. Non-compliance leads to penalties

- Robust non-fiscal strategies can keep electric vehicles relevant and desirable. Such measures include number plate restrictions, lower cost or free parking, traffic restrictions with waivers to EVs and even a national / regional target to completely ban on the sale of combustion engines

Will this impact EV demand?

The Indian electric vehicle market has shown high sensitivity towards fluctuations in incentives in the past. In June 2021, incentives for two-wheelers under FAME were increased to ₹15,000 per kWh, with a 40 per cent cap on ex-factory cost. This led to a 274 per cent increase in sales of electric two-wheelers in the month of June, and 213 per cent increase in July compared to their previous months respectively.

When in June 2023, the policy reinstated the discount to ₹10,000 per kWh with a 15 per cent cap on cost, the sales plummeted by 56 per cent.

Sensitivity to demand incentives, monthly registrations of e-two-wheelers

CSE calculations based on Vahan data

FAME II has managed to keep up the demand for electric vehicles in the country, coupled with the efforts made by states in their state EV policies, and the growth rates have been positive so far. It is too early to comment on EMPS’ impact on sustaining the adoption trend in India.

Augmenting such subsidy programmes with supply side mandates and strong non-fiscal incentives is the need of the hour. Despite its resemblance to FAME, we are yet to see if EMPS becomes a case of “same family, different name” or a suboptimal approach wrapped in a refreshed moniker.

We are a voice to you; you have been a support to us. Together we build journalism that is independent, credible and fearless. You can further help us by making a donation. This will mean a lot for our ability to bring you news, perspectives and analysis from the ground so that we can make change together.