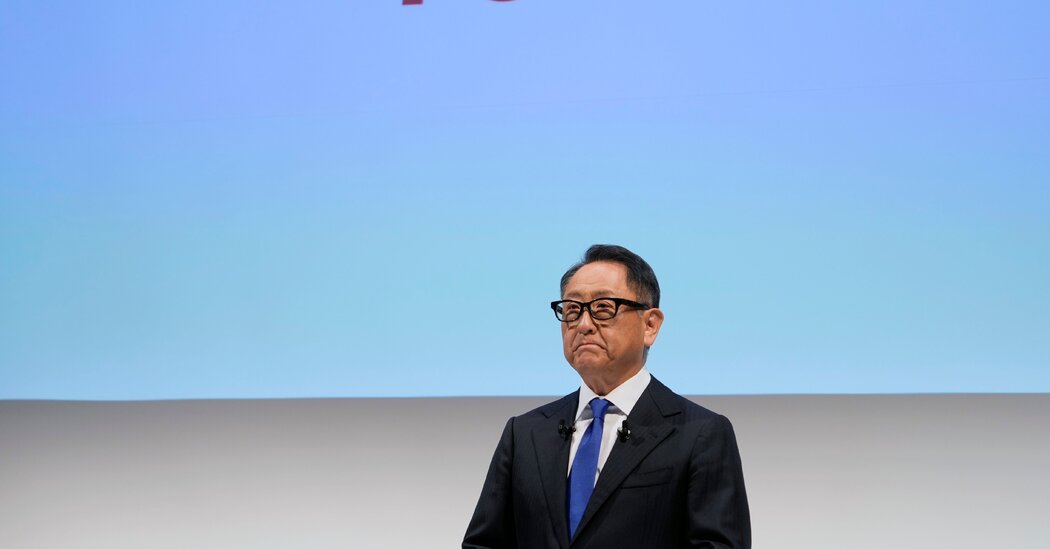

During his long tenure as chief executive, Akio Toyoda led Toyota Motor to the top of the car industry.

Toyota today sells more cars than any other automaker in the world. It was Mr. Toyoda’s bet on the enduring popularity of hybrid gas-electric vehicles that last year helped Toyota achieve the biggest annual profit in Japanese history.

Mr. Toyoda, whose grandfather founded Toyota in 1937, is the force that propels the company — and that is a problem, according to multiple people inside and outside of Toyota.

In early 2023, Mr. Toyoda stepped down after nearly 14 years as chief executive to become chairman. But a little more than a year after the new chief executive took over, some Toyota board members have flagged concerns that Mr. Toyoda is continuing to drive major projects and may retain too much unchecked sway within the company.

Several big Toyota investors said they planned to vote against his re-election to the board of directors ahead of the company’s annual shareholder meeting, which will be held on Tuesday.

“You have a case of a particularly empowered executive sitting in a chairman’s role,” said Michael Garland, the head of corporate governance at the New York City Comptroller’s Office, which manages the city’s more than $260 billion retirement fund system. “Toyota’s need for more independent board oversight is significant.”

Replacing successful chief executives, especially those with long tenures, is often tricky. Companies must make sure they clear a smooth path for successors to take over without undermining business practices that are working and, most important, producing profits.

“Not having ample checks and balances is just bad governance, but course correct too much and a company can just lose its momentum completely,” said Howard Yu, director of IMD Business School’s advanced management program. “Toyota is at this critical juncture.”

Mr. Toyoda, 68, navigated Toyota through several bruising episodes as chief executive. In 2009, when he took over, the global financial meltdown put the company in the red, and Toyota was starting to contend with a series of quality problems that would balloon into the worst crisis in its history.

In 2009 and 2010, Toyota recalled millions of vehicles for repairs after reports emerged of its vehicles accelerating uncontrollably. Toyota would eventually face hundreds of wrongful-death and personal-injury lawsuits and be hit with a $1.2 billion fine by the United States Justice Department.

In 2010, Mr. Toyoda apologized to Congress and vowed to change what he said was a disconnect between Toyota’s executives in Japan and the company’s global operations. He slimmed down the executive ranks, transferred power to regional heads and cut costs. Toyota’s sales climbed.

In recent years, Mr. Toyoda became known for his comments warning politicians and industry officials not to move too quickly toward electric vehicles, before consumers were ready to leave behind their gasoline-powered cars.

While other automakers in the United States, Europe and China started a sharp shift to electric vehicles, Toyota continued to invest in the hybrid cars it pioneered in the late 1990s. That frequently made Mr. Toyoda the target of criticism by environmental groups.

In January 2023, Toyota announced that a longtime Toyota engineer, Koji Sato, would take over as chief executive. Mr. Toyoda said Mr. Sato, 53 at the time, had the skills necessary to guide Toyota into a new age of electric and software-driven cars.

Shortly after Mr. Sato took over, global car market dynamics shifted. Electric vehicle sales cooled, and demand for hybrid cars skyrocketed, generating a windfall for Toyota. Toyota posted more than 5 trillion yen ($32 billion) in operating profit for the fiscal year that ended in March, the largest ever recorded for a Japanese company.

Internally, people at Toyota said the recent earnings — and the company’s expected strong performance over the next three to four years — should be credited to Mr. Toyoda for having mapped out the electric vehicle transition.

“Akio Toyoda has been proven right,” said Jeffrey Liker, who heads the Ann Arbor, Mich., consulting firm Liker Lean Advisors and has written extensively about Toyota and its management.

Despite having stepped down as chief executive, Mr. Toyoda “may have more influence than he wants, even, by virtue of the fact that when he offers an opinion people now take it as the word of God,” Mr. Liker said.

Still, while Toyota’s profits are soaring, some board members have grown concerned that the success is further cementing what they see as a potentially problematic concentration of power by Mr. Toyoda, according to three people with knowledge of the situation who were not authorized to speak about internal matters.

Mr. Toyoda made big changes to Toyota management in recent years, and six new directors were appointed to the board in 2023. Earlier this year, Ikuro Sugawara, an outside director, told a Japanese magazine that the moves had left Mr. Toyoda surrounded by people who do not question him.

“Mr. Akio has changed,” the magazine, Shukan Bunshun, quoted Mr. Sugawara saying in an interview that got little attention outside of Japan. “He used to have people around him who voiced their opinions.” Toyota did not make Mr. Sugawara available for an interview.

Some members of Toyota management see Mr. Toyoda as playing the role of both chairman and chief executive, commanding the room in meetings and continuing to drive major company initiatives, such as plans for a new line of combustion engines for hybrid cars announced last month, according to the three people with knowledge of the situation. Some directors believe a slow handoff of authority is appropriate, as Mr. Sato learns from his longtime boss, one of the people said.

Toyota did not respond to requests for comment.

The internal commotion has attracted attention from investors. People at seven large investor groups, some of which were not authorized to speak publicly, told The New York Times that they planned to vote against re-electing Mr. Toyoda because of concerns about the board’s independence.

Two prominent firms that advise investors on corporate matters, Glass Lewis and Institutional Shareholder Services, have urged shareholders to vote against Mr. Toyoda’s re-election because of governance issues and what they see as his responsibility for testing problems in Japan disclosed recently by Toyota and some of its group companies.

In Japan, board members are often re-elected with near unanimous shareholder support, and investors voting against Mr. Toyoda’s reappointment are likely to remain a small minority. Over the past decade, Mr. Toyoda’s reappointment votes have received an average approval of more than 96 percent.

Last year was Mr. Toyoda’s final year leading Toyota’s annual shareholder meeting, which was held at its headquarters in Toyota City, southwest of Tokyo. Mr. Toyoda teared up and said he was looking forward to seeing the future Mr. Sato would create for Toyota.

This year will be the first time Mr. Sato will preside over the meeting.

According to Mr. Yu, of the IMD Business School, how Toyota navigates the succession could determine the company’s future.

“A company would want to transition power to a new generation to take itself in a new direction,” Mr. Yu said. “The key question to ask about Toyota is does it, right now, need to reinvent — or not.”

Hisako Ueno contributed reporting.